UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x☒

Filed by a Party other than the Registrant ¨☐

Check the appropriate box:

☒ | ||

Preliminary Proxy Statement |

☐ | ||

Confidential, |

☐ | ||

Definitive Proxy Statement |

☐ | ||

Definitive Additional Materials |

☐ | ||

Soliciting Material Pursuant to §240.14a-12 |

Commerce Union Bancshares,

Reliant Bancorp, Inc.

(Name of Registrant as Specified In Itsin its Charter)

N/A

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ | ||||

No fee required. | ||||

☐ | ||||

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||||

(1) | Title of each class of securities to which transaction applies: | |||

(2) | Aggregate number of securities to which transaction applies: |

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule |

(4) | Proposed maximum aggregate value of transaction: |

(5) | Total fee paid: |

☐ | ||||

Fee paid previously with preliminary materials. | ||||

☐ | ||||

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||||

(1) | Amount Previously Paid: | |||

(2) | Form, Schedule or Registration Statement No.: |

(3) | Filing Party: |

(4) | Date Filed: |

1736 Carothers Parkway, Suite 100

Brentwood, Tennessee 37027

May 14, 2015

April 10, 2018

Dear fellow shareholder:

You are cordially invited to attend the annual meeting of shareholders of Commerce Union Bancshares,Reliant Bancorp, Inc. (the “Company”). This letter serves as your official notice that we will hold the annual meeting on June 18, 2015,Thursday, May 17, 2018, at 5:00 p.m., local time, at the Tennessee Bankers Association, located at 211 Athens Way, Nashville, Tennessee 37228, forto take action the following purposes:following:

● | Election of Directors: Elect five nominees to serve as Class I directors, |

● | Ratification of the |

● | Articles of Amendment to the |

● | Employee Stock Purchase Plan. To |

If you were a shareholder of record of Company common stock as of the close of business on April 9, 2018, you are entitled to receive this notice and vote at the annual meeting, and any adjournments or postponements thereof. This proxy statement and accompanying proxy card are being sent or made available on or about April 10, 2018.

For instructions on voting, please refer to the enclosed proxy card. You may vote by mail, as well as by telephone and on the internet. Your vote is important. Whether or not you planexpect to attend the annual meeting, we hope you will vote as soon as possible. You may vote over the internet, as well as by telephone, or by mailing a proxy card. Detailed voting instructions are included on your proxy card. However, ifit is important that your shares are held in “street name,” you will need to obtain a proxy form frombe represented and voted at the institution that holds your shares in order to vote at our annual meeting.

By order of the board of directors,

DeVan D. Ard, Jr. |

| ||||

| Chairman, President and Chief Executive Officer |

COMMERCE UNION BANCSHARES,RELIANT BANCORP, INC.

1736 Carothers Parkway, Suite 100

Brentwood, Tennessee 37027

May 14, 2015

April 10, 2018

PROXY STATEMENT FOR ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD JUNE 18, 2015To Be Held May 17, 2018

General

Our board of directors is soliciting proxies for the 2018 annual meeting of shareholders. This proxy statement is being furnishedcontains important information for you to consider when deciding how to vote on the shareholders of Commerce Union Bancshares, Inc.matters brought before the annual meeting. We encourage you to read it carefully. We are distributing this proxy statement on or about April 10, 2018. In this proxy statement, the terms “we,” “our,” “ours,” “us,” “Commerce UnionReliant Bancorp” and the “Company” refer to Commerce Union Bancshares,Reliant Bancorp, Inc. The terms “Reliant” and “Reliant Bank” refer to our wholly owned subsidiary, Reliant Bank, a Tennessee banking corporation.

The accompanying proxy is solicited on behalf of

About the board of directors of Commerce Union Bancshares, Inc. for use at our 2015Annual Meeting

The annual meeting of shareholders. The annual meetingshareholders of Reliant Bancorp will be held on Thursday, June 18, 2015,May 17, 2018, at 5:00 p.m., local time, at the Tennessee Bankers Association, located at 211 Athens Way, Nashville, Tennessee 37228. The meeting is

Proposals at the Annual Meeting

You are being held to:asked to vote on the following proposals:

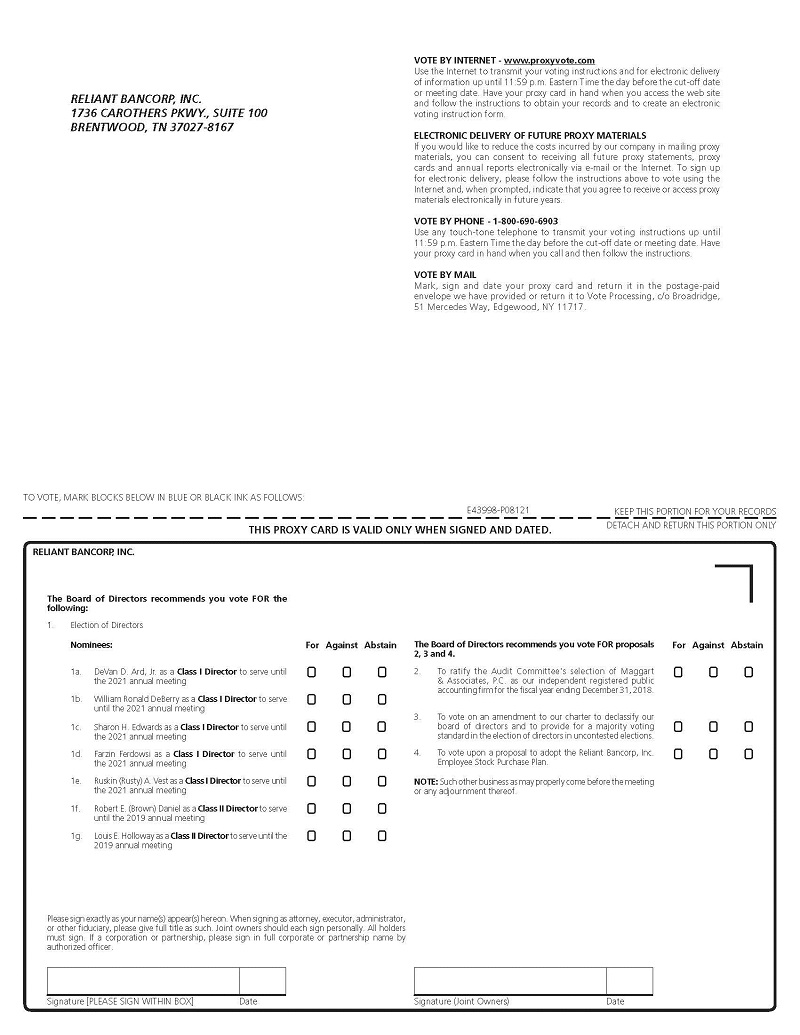

1. | A proposal to |

2. | A proposal to ratify the |

3. | A proposal to approve an amendment to our charter to declassify our board of directors and |

4. | A proposal to approve the Reliant Bancorp, Inc. 2018 Employee Stock Purchase Plan (which we refer to as |

We do not know of any business that will be presented for consideration at the Meeting other than the matters described in this proxy statement. This proxy statement is dated May 14, 2015, and is being mailed or otherwise made available to the shareholders of Commerce Union on or about May 20, 2015, along with the form of proxy.

Voting Information

The board set May 13, 2015April 9, 2018 as the record date for the annual meeting. Shareholders owning shares of our common stock at the close of business on that date are entitled to attend and vote at the annual meeting, with each share entitled to one vote. There were 7,062,508approximately [11,479,587] shares of common stock outstanding on the record date. A majority of the outstanding shares of common stock entitled to vote at the annual meeting will constitute a quorum. We will count abstentions and broker non-votes, which are described below, in determining whether a quorum exists.

Many of our shareholders hold their shares through a stockbroker, bank, or other nominee rather than directly in their own name. If you hold our shares in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in street name, and your broker or nominee, who is considered the shareholder of record with respect to those shares, is forwarding these materials to you. As the beneficial owner, you have the right to direct your broker, bank, or other nominee how to vote and are also invited to attend the annual meeting. However, since you are not the shareholder of record, you may not vote these shares in person at the annual meeting unless you obtain a signed proxy from the shareholder of record giving you the right to vote the shares. Your broker, bank, or other nominee has enclosed or provided a voting instruction card for you to use to direct your broker, bank, or other nominee how to vote these shares.

If a share is represented for any purpose at the annual meeting by the presence of the registered owner or a person holding a valid proxy for the registered owner, it is deemed to be present for the purpose of establishing a quorum. Therefore, valid proxies which are marked “Abstain” or “Withhold”“Abstain” or as to which no vote is marked, including broker non-votes (which are described below), will be included in determining the number of votes present or represented at the annual meeting.

When you sign the proxy card or submit your vote via the internet, you appoint DeVan D. Ard, Jr. and William R.(Ron) DeBerryJ. Dan Dellinger as your representatives at the annual meeting. Messrs. Ard and DeBerryDellinger will vote your proxy as you have instructed them on the proxy card. If you submit a proxy but do not specify how you would like it to be voted, Messrs. Ard and DeBerryDellinger will

1

vote your proxy for the election to the board of directors of all nominees listed below under “Election of Directors,” for the approval of the equity compensation plan andDirectors”, for the ratification of the appointment of our independent registered public accountants for the year ending December 31, 2015.2018, for the charter amendment proposal, and for the employee stock purchase plan proposal. We are not aware of any other matters to be considered at the annual meeting. However, if any other matters come before the annual meeting, Messrs. DeBerryArd and ArdDellinger will vote your proxy on such matters in accordance with their judgment.

Broker non-votes

A broker non-vote occurs when a broker submits a proxy card with respect to shares held in a fiduciary capacity (typically referred to as being held in “street“street name”) but declines to vote on a particular matter because the broker has not received voting instructions from the beneficial owner. Under the rules that govern brokers who are voting with respect to shares held in street name, brokers have the discretion to vote such shares on routine matters, but not on non-routine matters. The ratification of auditors is a routine matter. The other matters to be addressed at the annual meeting, including the election of directors, the charter amendment proposal, and the approval of the equity compensationemployee stock purchase plan proposal are non-routinenot routine matters.

Voting and quorum requirements at the annual meeting

In order to have a meeting, it is necessary that a quorum be present. A quorum will be present if a majority of the shares of common stock are represented at the annual meeting in person or by proxy. Abstentions and broker non-votes will be counted for purposes of determining the presence or absence of a quorum. Abstentions and broker non-votes will not be counted as having voted either for or against a proposal.

Assuming

ANNUAL MEETING BUSINESS | ||||||||

Item | Proposal | Vote Required for Approval | Effect of Abstentions | Broker Discretionary Voting Allowed? | Effect of Broker Non-Votes | |||

| 1 | Election of Directors | Plurality* | No effect; not treated as a vote cast, except for quorum purposes | No | No Effect | |||

| 2 | Ratification of Independent Registered Public Accounting Firm | Votes cast “For” exceed “Against” votes | No effect; not treated as a vote cast, except for quorum purposes | Yes | Not Applicable | |||

| 3 | Charter Amendment Proposal | Majority of common stock outstanding | No effect; not treated as a vote cast, except for quorum purposes | No | No Effect | |||

| 4 | Employee Stock Purchase Plan Proposal | Votes cast “For” exceed “Against” votes | No effect; not treated as a vote cast, except for quorum purposes | No | Not Applicable | |||

* Our Corporate Governance Guidelines require that a quorum is present:nominees to the board of directors who receive more votes cast against their election than for their election to tender their resignation to the board following the annual meeting.

As to any other matter that may be properly brought before the annual meeting, your proxy will be voted as our board of directors may recommend. If our board of directors makes no recommendation, your proxy will be voted as the proxy holders named in your proxy card deem advisable. As of the date of this proxy statement, our board of directors does not know of any other matter that is expected to be presented for consideration at the annual meeting.

You may revoke your proxy and change your vote at any time before the polls close at theannual meeting. If you are the record holder of the shares, you may do this by (a) signing and delivering another proxy with a later date, or (b) by voting in person at the meeting, or (c) by voting again over the internet or by telephone prior to 5:00 p.m. local time on June 18, 2015.

2

Solicitation of proxies

Solicitations of proxies may be made in person or by mail, telephone, or other means. We are paying for the costs of preparing and mailing the proxy materials and of reimbursing brokers and others for their expenses of forwarding copies of the proxy materials to our shareholders. Our directors, officers, and employees may assist in soliciting proxies but will not receive additional compensation for doing so.

On request, we will provide, without charge, a copy of our Annual Report on Form 10-K for the year ended December 31, 2014,2017, as filed with the SEC (including a list briefly describing the exhibits thereto), to any shareholder.Please contact us at (615) 384-3357,221-2020, or write to J. Daniel Dellinger, our Chief Financial Officer, at 1736 Carothers Parkway, Suite 100, Brentwood, Tennessee 37027,for any such request.

About the Merger of

Recent Mergers

Commerce Union /Legacy Reliant Bank and ReliantMerger

Effective

On April 1, 2015, Commerce Unionthe Company completed the mergeracquisition of legacy Reliant Bank, a Tennessee banking corporation (“Legacy Reliant Bank”). The Legacy Reliant Bank merger was accounted for as a reverse merger using the acquisition method of accounting, in accordance with andthe provisions of FASB ASC Topic 805-10 Business Combinations. As such, for accounting purposes, Legacy Reliant Bank was considered to be acquiring Reliant Bancorp in this transaction. As a result, the financial statements of the Company prior to the Legacy Reliant Bank merger are the historical financial statements of Legacy Reliant Bank. In periods following the Legacy Reliant Bank merger, the comparative historical financial statements of the Company are those of Legacy Reliant Bank prior to the merger. These consolidated financial statements include the results attributable to the operations of the Company beginning on April 1, 2015.

Community First, Inc. Merger

On August 22, 2017, Reliant Bancorp entered into Commerce Union’s subsidiary bank, Commerce Union Bank, pursuant to an Agreement and Plan of Merger dated aswith Community First, Inc. (“Community First”), Pioneer Merger Sub, Inc., a wholly owned subsidiary of April 25, 2014, as amended by the First Amendment to the Agreement and Plan of Merger, dated as of December 31, 2014, by and among Commerce Union, Commerce UnionReliant Bancorp, Reliant Bank, and ReliantCommunity First Bank (the “& Trust, a Tennessee-chartered commercial bank and wholly owned subsidiary of Community First (“merger agreementCommunity First Bank”). At closingOn January 1, 2018, Reliant Bancorp completed the acquisition of the merger, Reliant Bank merged withCommunity First and into Commerce Union Bank, with Commerce Union Bank surviving the merger as the surviving corporation.Community First Bank.

PROPOSAL

ITEM ONE

ELECTION OF DIRECTORS

Nominees and Vote Required to Elect Nominees

The board of directors currently has 1114 members divided into three classes with staggered terms, so that the terms of only approximately one-third of the board membersmembers’ terms expire at each annual meeting. The current terms of the Class I directors will expire at the 20152018 annual meeting of shareholders. The Class I directors will stand for election again at the annual meeting of shareholders in 2021. The terms of the Class II directors will expire at the 20162019 annual meeting of shareholders, and the terms of the Class III directors will expire at the 20172020 annual meeting of shareholders.

Effective January 1, 2018, in connection with the consummation of the merger between Reliant Bancorp and Community First, Inc. (“Community First”), our board of directors approved an increase to the size of the board of directors from 11 to 14 members, and the board of directors approve the appointment of three legacy Community First directors, Robert E. (Brown) Daniel, Louis E. Holloway, and Ruskin (Rusty) A. Vest, to fill the resulting vacancies. Mr. Vest was appointed to serve as a Class I director, and Messrs. Daniel and Holloway were appointed to serve as Class II directors. If elected by the shareholders at the annual meeting, Mr. Vest will be elected for a three-year term, serving until the annual meeting of shareholders in 2021. If elected by the shareholders at the annual meeting, Messrs. Daniel and Holloway will be elected for a one-year term, serving until the annual meeting of shareholders in 2019.

If the shareholders approve the proposed charter amendment at the annual meeting, we will begin to phase out the staggered terms for our board of directors. If the charter amendment is adopted, at the annual meeting of shareholders in 2019, Class II directors will be elected to one-year terms, and at the annual meeting of shareholders of 2020, Class III directors will be elected to one-year terms. Beginning with the annual meeting of shareholders in 2021, all directors will be elected for a one-year term.

Our current directors and their classes are:

Name | Board class | |

Homayoun Aminmadani | Class II Director | |

DeVan D. Ard, Jr. | Class I | |

Charles Trimble (Trim) Beasley | Class II Director | |

John Lewis (Buddy) Bourne | Class III Director | |

Robert E. (Brown) Daniel | Class II Director* | |

William Ronald (Ron) DeBerry | Class I | |

Sharon H. Edwards | Class I | |

Farzin Ferdowsi | Class I | |

Darrell S. Freeman, Sr. | Class III Director | |

James Gilbert Hodges | Class III Director | |

Louis E. Holloway | Class II Director* | |

James R. Kelley | Class III Director | |

Don Richard Sloan | Class II Director | |

Ruskin (Rusty) A. Vest | Class I Director* |

* Standing for election by the shareholders |

Under the terms of the merger agreement, at the effective time of the merger, the number of directors on the board of directors of Commerce Union was set at 11, of which five were previous members of the Reliant Bank board of directors, five were previous members of the Commerce Union board of directors, and one is an agreed-upon individual who is independent from the combined company under the listing rules of NASDAQ. Of the previous Reliant Bank board members, Mr. Ard and Mr. Ferdowsi were appointed as Class I directors and are standing for election at the annual meeting. Of the

3

former Commerce Union board members, Mr. DeBerry was appointed as a Class I director and is standing for election at the annual meeting. Additionally, in connection with the consummation of the merger, the board appointed Sharon H. Edwards to serve as a Class I director and as the agreed-upon individual who is independent from the combined company.

The board of directors recommends that you elect Mr.Ms. Edwards and Messrs. Ard, Mr. DeBerry, Mr. Ferdowsi, and Ms. EdwardsVest as Class I directors, and Messrs. Daniel and Holloway as Class II directors. If a quorum is present, the directors will be elected by a plurality of the votes cast at the annual meeting. This means that the four nominees receiving the highest number of votes will be elected directors. Abstentions, broker non-votes, and the failure to return a signed proxy will have no effect on the outcome of the vote on this matter. If you submit a proxy but do not specify how you would like it to be voted, Messrs. Ard and DeBerryDellinger will vote your proxy to elect Mr. Ard, Mr. DeBerry, Mr. Ferdowsi and Ms. Edwards.the individuals nominated by the board. If any of these nominees is unable or fails to accept nomination or election (which we do not anticipate), Messrs. Ard and DeBerryDellinger will vote instead for a replacement to be recommended by the board of directors, unless you specifically instruct otherwise in the proxy.

Information About theabout Directors

The following table shows for each director of Commerce UnionReliant Bancorp as of May 1, 2015:March 26, 2018: (1) his or her name; (2) his or her age as of May 1, 2015;age; (3) how long he or she has been a director of Commerce Union;Reliant Bancorp or Reliant Bank; (4) his or her position(s) with Commerce UnionReliant Bancorp or Commerce UnionReliant Bank, other than as a director; and (5) his or her principal occupation and business experience for the past five years. Except as otherwise indicated, each director has been engaged in his or her present principal occupation for more than five years.

Name (Age) | Director Since

| Positions and Business Experience | ||||

Homayoun Aminmadani |

| Homayoun Aminmadani is a veteran restaurateur with more than 40 years of experience in the YUM! Brands, Inc. as a franchisee of various brands. During these years, Mr. Aminmadani has developed over 150 Pizza Hut restaurants and,

Mr. Aminmadani was a director of Reliant Bank from 2006 to 2015 and was appointed to the | ||||

DeVan D. Ard, Jr. | 2015 | DeVan Ard, Jr. is the

Playing an active role in the business and nonprofit community, Mr.

Mr. Ard holds a |

4

Charles Trimble Beasley | 2006 | Trim Beasley is currently the president of Center Star, Inc., a research and development firm specializing in thermal reflective material properties. He graduated from Vanderbilt University with a Bachelor of Engineering degree in 1970 and went on to earn a Master of Business Administration degree from the University of Tennessee in 1975. Mr. Beasley began his business career with Everett Beasley, Inc., serving as company president for 17 years before selling his business interest in 1997. Since that time, he has been involved in numerous small business ventures, | ||

John Lewis Bourne | 2006 | Buddy Bourne is a veteran agricultural professional with over 31 years of experience in the tobacco industry. He graduated from Austin Peay State University with a Bachelor of Science degree in Agriculture. Since retiring from his position at Altria Client Services, his most recent employer, Mr. Bourne has continued to pursue his second career as a farmer, producing dark tobacco as well as grain crops. Over the course of his career, Mr. Bourne has been an active member in a variety of professional and community organizations, including the Middle Regional Advisory Council for the University of Tennessee Institute of Agriculture, the Alpha Gamma Rho fraternity, and the Delta Tau Alpha agricultural honor society. Mr. Bourne brings an extensive knowledge of agribusiness as well as a thorough understanding of local farming conditions to the board of directors of | ||

Robert E. Daniel (49) | 2018 | Brown Daniel is founder and president for Compass Capital, LLC, an investment company located in Franklin, Tennessee, a position he Mr. Daniel is an active member in the Williamson County community, serving as the secretary of the Williamson County Medical Center Board of Trustees. He previously served as chairman of the Boys and Girls Clubs of Franklin, and as chairman of the Thompson Station, Tennessee Planning Commission. Mr. Daniel was appointed to the board of directors of Reliant Bancorp following the merger with Community First, Inc. on January 1, 2018. He is a member of the audit committee of the board of directors. | ||

William Ronald DeBerry | 2006 | Ron DeBerry is Mr. DeBerry is an active member of the industry and the communities in which he works. He is a past director of the Tennessee Bankers Association. He serves as a board member and an executive committee member of the Middle Tennessee Council of Boy Scouts of America. He is a graduate of Leadership Nashville. He is a former president of PENCIL Foundation and past director of the Robertson County Chamber of Commerce. | ||

Sharon H. Edwards | 2015 | Ms. Edwards is the Finance Director of Willis Towers Watson North America, Finance Director of Willis Towers Watson Corporate Risk & Broking and the Chief Financial Officer of Willis North America, Ms. Edwards serves on the Willis Foundation Board of Directors. In addition to her duties at Willis Towers Watson, Ms. Edwards has served on the Board of Trustees for Pope John Paul II High School. In 2011, Ms. Edwards was selected as one of Business Insurance magazine’s 2011 “Women to Watch.” Additionally, Ms. Edwards was selected as a finalist for the Nashville Business Journal’s 2013 “Women of Influence” and a 2016 CABLE Board Walk of Fame honoree. She is a member of Women Corporate Directors, the AICPA, and Tennessee Society of CPA’s. Ms. Edwards serves as the board’s Lead Independent Director, and she chairs the board’s audit committee. | ||

Farzin Ferdowsi | 2015 | Farzin Ferdowsi has a long history of building successful franchises and serving in leadership roles in the banking and finance community in Middle Tennessee. He is chief executive officer of Brentwood, Tennessee-based Management Resources Company. Formed in 1971, MRCO manages | ||

5

Mr.

| ||||

Darrell S. Freeman, Sr. | 2015 | Darrell S. Freeman Sr. is theformer chairman of Zycron, Inc., an information technology services and solutions firm he founded in 1991 in Nashville, Tenn. Zycron employs more than

Mr. Mr. Freeman | ||

James Gilbert Hodges | 2008 | Jim Hodges is the president of Hodges Group, Inc., a construction company he started in 1990. He currently directs the overall construction management, organization, and operations of all projects and related construction activities for the corporation. Over the course of nearly 25 years, Mr. Hodges has succeeded in expanding his | ||

Louis E. Holloway (65) | 2018 | Louis Holloway is Chief Operating Officer of Reliant Bancorp and Reliant Bank, and he has over 30 years of experience in the banking industry. Prior to joining Reliant Bancorp and Reliant Bank, Mr. Holloway was the chief executive officer of Community First and Community First Bank, a position he held since 2012. Before has CEO, Mr. Holloway served Community First Bank in various positions, including president, chief credit officer, and chief retail officer. Prior to joining Community First Bank in 2008, Mr. Holloway served in market development for Bank of America as senior vice president/market president in Macon, Georgia from 1997 to 2007. He also held various positions in lending and consumer business. Mr. Holloway was appointed to the board of directors of Reliant Bancorp following the merger with Community First, Inc. on January 1, 2018. | ||

James R. Kelley | 2015 | Jim Kelley is a member of Neal & Harwell, PLC. His practice is focused primarily in the areas of commercial law, bankruptcy, taxation and general corporate matters. He earned his degree from Vanderbilt University and graduated from Emory Law School with distinction receiving a JD and an LLM in Taxation. He has received many professional accolades including recognition as one of |

6

Mr. Kelley is active in many civic and charitable

| ||||

Don Richard Sloan | 2006 | Don Sloan is an independent pharmacist who has owned and operated South Side Drug Company in Springfield, | ||

Ruskin A. Vest, Jr. (63) | 2018 | Rusty Vest is a successful entrepreneur and owner of several businesses in Maury County and surrounding areas. He is president and part-owner of Southeastern Shirt Corporation, a position he has held since 1986, and president and part-owner of Southeastern Pant, LLC, a position he has held since 1996. He is the former executive vice president of Service Partners Industrial Products Co., LLC, a wholly-owned subsidiary of Masco Corporation that is a building materials distributor, a position he held from 1984 to 2015. Mr. Vest is also an active member of the Maury County community and serves on the Executive Committee of the Board of Trustees of the Webb School in Bell Buckle, Tennessee. Mr. Vest’s wide variety of business experience, including manufacturing and real estate development, allows him to bring to the board of directors a broad understanding of a number of industries in which many of the Company’s clients operate. His active involvement in a number of community activities in the Company’s Maury County market allows him to contribute valuable insight to the board of directors on key developments in the Middle Tennessee market. Mr. Vest was appointed to the board of directors of Reliant Bancorp following the merger with Community First, Inc. on January 1, 2018. He is a member of the nominating and governance committee of the board of directors. | ||

Information about Executive Officers

Set forth below is information about our executive officers, other than Mr. DeBerry, our chief executive officer, and Mr. Ard, our President and Chief Executive Officer, who are also directors and areis discussed above.

Name (Age) | Officer Since | Positions and Business Experience | ||

J. Dan Dellinger Chief Financial Officer | 2015 | Dan Dellinger is the Chief Financial Officer of

Prior to his career in banking, Mr. Dellinger spent 11 years in public accounting. He is a

Mr. Dellinger has participated on several CFO panels for the AICPA and the Tennessee Bankers Association. Mr. Dellinger has also served as an instructor for The Southeastern School of Banking. He served as a director for the Independent Division of the Tennessee Bankers Association for 3 years. He currently serves as a member of the Tennessee Bankers

Mr. Dellinger is a member of the Executive Board for the Middle Tennessee Council of the Boy Scouts of America. He also serves on the Finance |

7

|

|

| ||

| Mr. Dellinger received his | ||||

Terry M. Todd (59) Executive Vice President and Chattanooga Market President | 2017 | Prior to joining Reliant Bank in 2017, Terry Todd was regional president for FSG Bank in Chattanooga, where he was responsible for 12 branches with $270 million in loans and $175 million in deposits. He previously served as business banking manager for SunTrust Bank’s Chattanooga Region that included 40 plus branches over a three-state area. He started his banking career in 1981 at the former Commerce Union Bank, later Bank of America. Mr. Todd is a graduate of the University of Tennessee at Martin. He is also a graduate of the Banking School of the South at Louisiana State University, the Tennessee Bank Commercial Lending School and the Tennessee Bank Consumer Lending School. He is actively involved in the Chattanooga community on non-profit and other community boards. | ||

John R. Wilson (60) Chief Lending Officer and Davidson/Williamson County Market President | 2006 | John Wilson has over 20 years of community and regional banking experience. Prior to joining Reliant Bank, he launched Cumberland Bank’s entry into the Spring Hill market where he served as community president. Mr. Wilson also held positions at Tennessee National Bank and First National Bank of Lewisburg, which was later acquired by Nations Bank. Mr. Wilson serves on the board of directors for the Boys & Girls Club of Franklin and Williamson County where he was formerly the Club’s Treasurer and now currently serves as the Club’s Chairman. Mr. Wilson is a graduate of the Tennessee School of Banking and the Graduate School of Banking of The South, Baton Rouge, Louisiana. He also holds a bachelor’s degree from the University of Tennessee. |

Family Relationships

Mr. DeBerry, our chairman and chief executive officer, is married to Paula DeBerry, our Executive Vice-President, Chief Retail Officer and Sumner County Market Vice President.

Certain Other Related Transactions

Commerce Union

Reliant Bank has had, and expects to have in the future, loans and other banking transactions in the ordinary course of business with its directors (including independent directors) and executive officers of Reliant Bancorp and Reliant Bank, including members of their families or corporations, partnerships or other organizations in which such officers or directors have a controlling interest. These loans are made on substantially the same terms (including interest rates and collateral) as those available at the time for comparable transactions with persons not related to Commerce UnionReliant Bank and diddo not involve more than the normal risk of collectability or present other unfavorable features.

In addition, Commerce UnionReliant Bank is subject to the provisions of Section 23A of the Federal Reserve Act, which places limits on the amount of loans or extensions of credit to, or investments in, or certain other transactions with, affiliates and on the amount of advances to third parties collateralized by the securities or obligations of affiliates. Commerce UnionReliant Bank is also subject to the provisions of Section 23B of the Federal Reserve Act which, among other things, prohibits an institution from engaging in certain transactions with certain affiliates unless the transactions are on terms substantially the same, or at least as favorable to such institution or its subsidiaries, as those prevailing at the time for comparable transactions with nonaffiliated companies.

The aggregate principaldollar amount of loans outstanding to Commerce Union’s directors and executive officers of Reliant Bank and their respective affiliatesReliant Bancorp was approximately $10.5$8.6 million at April 30, 2015.December 31, 2017.

Reliant Mortgage Ventures, LLC (“Reliant Mortgage Ventures”) is a former subsidiary of Reliant Bank and currently a subsidiary of Commerce Union Bank, which provides mortgage banking services to bank customers. Roger Williams is the president of Reliant Mortgage Ventures, LLC, and Mr. Dellinger is the secretary. This entity was formed as a Tennessee limited liability company in 2011 and has two members, Commerce UnionReliant Bank and VHC Fund 1, LLC, a Tennessee limited liability company. Commerce UnionReliant Bank holds 51% of the governance rights and 30% of the financial rights.rights of Reliant Mortgage Ventures. VHC Fund 1, LLC holds 49% of the governance rights and 70% of the financial rights.rights Reliant Mortgage Ventures. VHC Fund 1, LLC is controlled by an immediate family member of Mr. Ferdowsi.

Policies on Related Party Transactions

Related party transactions are governed by our Code of Ethics, which applies to all officers, directors and employees. This code covers a wide range of potential activities, including, among others, conflicts of interest, self-dealing, and related party transactions. Waiver of the policies set forth in this code will only be permitted when circumstances warrant. Such waivers for directors and executive officers, or that provide a benefit to a director or executive officer may be made only by the board of directors, as a whole, or the audit committee of the board of directors and must be promptly disclosed as required by applicable law or regulation. Absent such a review and approval process in conformity with the applicable guidelines relating to the particular transaction under consideration, such arrangements are not permitted.

Involvement in Certain Legal Proceedings

In 2008, Messrs. Ferdowsi and Aminmadani each owned a 45% equity interest in (i) American Hospitality Corporation, (ii) Restaurant Management of Carolina, L.P., and (iii) East West Enterprises, LLC. These three entities owned and operated approximately 80 franchised restaurants in the southeastern U.S.United States. In November 2008, one of three lenders to those entities declared a non-monetary default under a credit agreement and subsequently filed a complaint in the U.S. District Court for the Middle District of Tennessee in Nashville seeking the appointment of a receiver for the entities. Messrs. Ferdowsi and Aminmadani, along with the other owners of the entities, all of whom were guarantors of the credit obligations, were also named as defendants in the receivership proceedings. The three entities, in turn, filed petitions for relief under Chapter 11 of the U.S. bankruptcy code in the U.S. Bankruptcy Court for the Middle District of Tennessee in Nashville. In 2009, the three entities and the owners negotiated a consensual Chapter 11 plan of reorganization with the creditors that provided for payment in full of all claims over time. The plan was effective on October 7, 2009. Under the terms of the Chapter 11 plan, Messrs. Ferdowsi and Aminmadani, along with the other owners, reaffirmed their guaranties. In 2010, all of the creditors received payment in cash in full payment of the claims.

Recommendation of our Board of Directors

OUR BOARD OF DIRECTORS RECOMMENDS THAT THE SHAREHOLDERS VOTE “FOR”“FOR” THE NOMINEES NAMED ABOVE.

8Security Ownership of Certain Beneficial Owners and Management

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information known to the companyCompany with respect to beneficial ownership of the company’sCompany’s common stock as of May 1, 2015March 15, 2018 for (i) each director and nominee, (ii) each holder of 5.0% or greater of the company’s common stock, (iii) the company’sCompany’s named executive officers, and (iv) all named executive officers and directors as a group. Unless otherwise indicated, the mailing address for each beneficial owner is care of Commerce Union Bancshares,Reliant Bancorp, Inc., 1736 Carothers Parkway, Suite 100, Brentwood, Tennessee 37027.

Name | Number of Commerce Union Shares Owned | Right to Acquire (1) | % of Beneficial Ownership As of May 1, 2015 (2) | Number of Reliant Bancorp Shares Owned | Right to Acquire (1) | % of Beneficial Ownership As of March 15, 2018 (2) | |||||||||||||||

Directors and Named Executive Officers | |||||||||||||||||||||

Homayoun Aminmadani (3) | 250,073 | 25,637 | 3.89 | % | |||||||||||||||||

DeVan D. Ard, Jr. (4) | 32,170 | 49,043 | 1.14 | % | |||||||||||||||||

Homayoun Aminmadani | 276,209 | 0 | 2.41% | ||||||||||||||||||

DeVan D. Ard, Jr. (3) | 69,606 | 7,607 | * | ||||||||||||||||||

Charles Trimble (Trim) Beasley | 28,875 | 26,250 | * | 27,256 | 0 | * | |||||||||||||||

John Lewis (Buddy) Bourne | 12,600 | 10,500 | * | 17,150 | 0 | * | |||||||||||||||

Robert E. (Brown) Daniel (4) | 176,776 | 0 | 1.54% | ||||||||||||||||||

William Ronald (Ron) DeBerry | 47,625 | 78,750 | 1.77 | % | 125,837 | 11,500 | 1.20% | ||||||||||||||

J. Daniel Dellinger | 17,163 | 27,064 | * | 44,348 | 7,085 | * | |||||||||||||||

Sharon Edwards | 0 | 0 | * | 8,500 | 0 | * | |||||||||||||||

Farzin Ferdowsi | 229,345 | 29,127 | 3.64 | % | 260,972 | 0 | 2.27% | ||||||||||||||

Darrell S. Freeman, Sr. | 53,690 | 16,361 | * | 70,551 | 0 | * | |||||||||||||||

James Gilbert Hodges | 5,344.60 | 0 | * | 5,845 | 0 | * | |||||||||||||||

Louis E. Holloway | 32,090 | 0 | * | ||||||||||||||||||

James R. Kelley | 34,801 | 4,342 | * | 39,643 | 0 | * | |||||||||||||||

Don Richard Sloan | 14,700 | 10,500 | * | 25,700 | 0 | * | |||||||||||||||

Terry Todd | 10,000 | 0 | * | ||||||||||||||||||

Ruskin A. Vest | 261,111 | 0 | 2.28% | ||||||||||||||||||

John Wilson | 20,681 | 4,053 | * | ||||||||||||||||||

All current directors and named executive officers as a group (12 persons) | 726,387 | 277,574 | 13.68 | % | |||||||||||||||||

All current directors and named executive officers as a group (17 persons) | 13.09% | ||||||||||||||||||||

5% Shareholders | |||||||||||||||||||||

RMB Capital Management, LLC (8) | 682,796 | 0 | 5.95% | ||||||||||||||||||

*Less than 1%

(1) | Includes shares that may be acquired within the next 60 days as of |

(2) | For each individual, this percentage is determined by assuming the named person exercises all options which he or she has the right to acquire within 60 days, but that no other persons exercise any options or warrants. For the directors and executive officers as a group and the |

(3) | 32,000 of these shares are pledged as security for a loan. |

(4) | Includes 16,015 shares held by Mr. Daniel’s spouse. |

(5) | Includes 24,800 shares and 4,000 options held by Mr. DeBerry’s spouse. 52,000 shares are pledged as security for a loan. |

(6) | Includes 13,136 shares and 2,532 options held by Mr. Dellinger’s spouse, and 537 shares held by Mr. Dellinger’s children. |

(7) | 229,345 of these shares are pledged as security for |

(8) | This information is derived from the Schedule 13G filed with the SEC on February 13, 2018 by RMB Capital Management, LLC. RMB Capital Management, LLC is the investment manager of |

THE COMPANY’S QUALIFIED RETIREMENT PLAN AND LONG-TERM EQUITY PLANS

401(k) Plan and Other Benefits

Reliant Bank has established the Reliant Bank 401(k) Plan pursuant to which it makes matching and discretionary contributions on behalf of each of the executive officers. Reliant Bank also maintains and pays premiums on behalf of each executive officer under a life insurance plan and provides partial payment of premiums for medical benefits if the executive officer so elects.

2011 Stock Option Plan

Background and Purpose. On April 28, 2011, Reliant Bancorp (f/k/a Commerce Union Bancshares, Inc.) adopted the Commerce Union Bancshares, Inc. Stock Option Plan for directors and management employees of Reliant Bancorp and Commerce Union Bank, and on March 10, 2015, the shareholders of Reliant Bancorp approved the Commerce Union Bancshares, Inc. Amended and Restated Stock Option Plan (as amended, the “2011 Stock Option Plan”). The 2011 Stock Option Plan permits the grant of awards of up to 1,250,000 shares of Reliant Bancorp common stock in the form of stock options. The 2011 Stock Option Plan was established to advance the interests of Reliant Bancorp shareholders by offering management and employees of Reliant Bancorp and Reliant Bank a flexible means of compensation and motivation for outstanding performance and by offering directors and organizers with a grant of equity for furthering the growth and profitability of each entity. The 2011 Stock Option Plan will continue to remain in effect until March 23, 2021; however, it is the intention of the Company that no new grants will be made under the 2011 Stock Option Plan going forward.

Eligibility. Any employee or director of Reliant Bancorp or Reliant Bank who is selected by the board of directors of Reliant Bancorp is eligible to receive grants under the 2011 Stock Option Plan. Only employees can receive grants of incentive stock options.

Administration. The 2011 Stock Option Plan is administered by the board of directors of Reliant Bancorp. The board of directors has the power to interpret the 2011 Stock Option Plan and to determine the type and amount of grants, the terms and conditions of the grants and the terms of agreements that will be entered into with the personnel receiving grants. Additionally, the board of directors has the power to amend any outstanding awards of options to the extent it deems appropriate, provided that the individual grantee’s consent is required if the amendment is adverse to the grantee’s interest. The board of directors has the power to make rules and guidelines for carrying out the 2011 Stock Option Plan and any interpretation by the board of directors of the terms and provisions regarding 2011 Stock Option Plan are final and binding.

Types of Awards. Stock options are rights to purchase a specified number of shares of common stock at a price fixed by the board of directors. Each option must be represented by an award agreement identifying the option as either an “incentive stock option,” within the meaning of Section 422 of the Code, or a “non-qualified stock option,” which does not satisfy the conditions of Section 422 of the Code. The award agreement also must specify the number of shares of common stock that may be issued upon exercise of the options, and set forth the exercise price of the options. The exercise price for options that qualify as incentive stock options may not be less than 100% of the fair market value of the common stock as of the date of grant. The option exercise price may be satisfied in cash or check payable to the order of Reliant Bancorp. Options have a maximum term of 10 years from the date of grant. The board of directors has broad discretion to determine the terms and conditions upon which options may be exercised, and the board of directors may determine to include additional terms in the award agreements.

Transferability. No options under the 2011 Stock Option Plan are transferable other than by a will or the laws of descent and distribution, as applicable.

Amendment and Termination. The board of directors may amend, alter, suspend or terminate the 2011 Stock Option Plan at any time. Any amendment to the plan must be approved by the stockholders to the extent such approval is required by the terms of the 2011 Stock Option Plan, the rules and regulations of the Securities and Exchange Commission, or the rules and regulations of any exchange upon which Reliant Bancorp’s stock is listed. However, no amendment, alteration, suspension or termination of the plan may impair the rights of any participant, unless mutually agreed in writing by the participant and the Committee.

Adjustments upon Change in Capitalization.In the event of a reorganization, recapitalization, stock split, stock dividend, issuance of securities convertible into stock, combination of shares, merger, consolidation or any other change in the corporate structure of Reliant Bancorp affecting any shares of stock, or a sale by Reliant Bancorp of all or substantially all of its assets, or any distribution to shareholders other than a normal cash dividend, or any assumption or conversion of outstanding grants as a result of an acquisition, the board of directors will make appropriate adjustments in the period of time in which non-qualified stock options may be exercised, the number and kind of shares authorized, and any adjustments in outstanding grants of options as deemed appropriate to maintain equivalent value providing that the incentive stock options will continue to meet the requirements of Code Sections 422 and 424.

Change in Control. If an event constituting a “change in control” (as defined in the 2011 Stock Option Plan) occurs, the outstanding options under the 2011 Stock Option Plan will continue to vest in accordance with the vesting schedule set forth in the option holder’s stock option agreement and continue to be exercised in accordance with terms set forth in the option holder’s stock option agreement.

2015 Equity Incentive Plan

General.On April 23, 2015, the board of directors adopted, and the Reliant Bancorp shareholders later approved at the 2015 annual meeting, the Commerce Union Bancshares, Inc. 2015 Equity Incentive Plan (the “2015 Plan”). The purpose of the 2015 Plan is to promote the Company’s interests by attracting and retaining employees through performance-related incentives to achieve long-range performance goals, enabling employees to participate in the financial success of the company, encouraging ownership of Company stock by employees, and linking employees’ compensation to the long-term interests of the Company and its shareholders. Additionally, the 2015 Plan provides for compensation for directors of Reliant Bancorp and its subsidiaries for their service as members of the various boards of directors through grants of non-qualified options and/or restricted stock. The 2015 Plan provides for compensation through incentive stock options, non-qualified stock options, restricted stock grants, and performance-based cash and equity awards.

Plan Term. The 2015 Plan’s term commenced upon shareholder approval at the 2015 annual shareholders meeting held on June 18, 2015, and will terminate on June 18, 2025 (subject to early termination as described herein).

Administration. The 2015 Plan is administered by a committee of the board, which the board has designated as the compensation committee. Subject to the express provisions of the 2015 Plan, the compensation committee is authorized to construe and interpret the 2015 Plan, and make all the determinations necessary or advisable for administration of the 2015 Plan.

Eligible Participants. The 2015 Plan provides that all directors and employees of Reliant Bancorp, its affiliated companies, and subsidiaries are eligible to receive grants of stock options, restricted stock, and performance-based cash and equity awards. Subject to the certain limitations, the compensation committee is empowered to determine which eligible participants, if any, should receive options, the number of shares subject to each option, and the terms and provisions of the option agreements.

Shares Subject to the 2015 Plan. The 2015 Plan provides for the issuance of options to purchase and awards of up to 900,000 shares of Reliant Bancorp’s common stock. Options will be granted at no less than the fair market value of the common stock as of the date of grant.

Incentive and Non-Qualified Stock Options. The 2015 Plan provides for the grant of both incentive stock options and non-qualified options. Incentive stock options are available only to persons who are employees of Reliant Bancorp or its subsidiaries, and are subject to limitations imposed by applicable sections of the Internal Revenue Code of 1986, as amended (the “Code”), including a $100,000 limit on the aggregate fair market value of shares of common stock with respect to which incentive stock options are exercisable for the first time by an optionee during any calendar year (under the 2015 Plan and all other “incentive stock option” plans of Reliant Bancorp). Any options granted under the 2015 Plan which do not meet the limitations for incentive stock options, or which are otherwise not deemed to be incentive stock options, shall be deemed “non-qualified”. Subject to the foregoing and other limitations set forth in the 2015 Plan, the exercise price, permissible time or times of exercise, and the remaining terms pertaining to any option are determined by the compensation committee; however, the per share exercise price under any option may not be less than 100% of the fair market value of the common stock on the date of grant of the option.

Restricted Stock Grants. The 2015 Plan provides that the compensation committee may grant restricted stock to employees or directors. Restricted stock grants shall consist of shares of common stock granted to a participant, subject to certain restrictions against disposition and certain obligations to forfeit such shares to the company.

Performance Based Awards. The compensation committee may set one or more performance goals, award amounts, and performance periods. The performance goals measure performance of our company or any subsidiary or business unit of our company within the performance period based on one or more of the following: (1) earnings or book value per share; (2) earnings, (3) return on equity, assets, capital or investment, (4) operating income or profit; (5) operating efficiencies; (6) the ratio of criticized/classified assets to capital; (7) allowance for loan and lease losses; (8) the ratio of non-performing assets to total assets; (9) the ratio of past due loans greater than 90 days and non-accruals to total loans; (10) the ratio of net charge-offs to average loans; (11) after-tax operating income; (12) cash flows; (13) total revenues or revenues per employee; (14) stock price or total shareholder return; (15) growth in loans, margins and/or deposits; (16) dividends; or (17) meeting specified revenue or expense targets; business, market and branch network expansion goals; and goals related to acquisition or divestitures. With respect to any covered officer, the maximum number of shares that may be granted as performance awards in each year of the performance period is 90,000 and the maximum amount of any cash award shall not exceed $200,000 in each year of the performance period.

Adjustment Provision. In the event that the Company issues dividends of cash or stock, recapitalizes, splits its stock, reorganizes, merges, consolidates, issues of warrants or other rights to purchase company stock, or engages in certain other corporate transactions, then the 2015 Plan gives the compensation committee the ability to adjust the number of shares with respect to which awards may be granted under the 2015 Plan, the number of shares subject to outstanding awards under the 2015 Plan, and to make certain other adjustments to awards under the 2015 Plan.

Award Agreements. At the time any award is made, the company and the participants will enter into an option agreement or restricted stock agreement (each, an “award agreement”) setting forth the terms of the award and such other matters as the compensation committee may determine to be appropriate. The terms and provisions of the award agreements need not be identical, and the compensation committee may, in its sole discretion, amend an outstanding award agreement at any time in any manner that is not inconsistent with the provisions of the 2015 Plan. The maximum number of shares that may be subject to awards granted to any one participant may not exceed 100% of the aggregate number of shares of common stock that may be issued under the 2015 Plan (as adjusted from time to time in accordance with the provisions of the Plan).

Equity Compensation Plan Information as of December 31, 2017

Plan category | Number of securities to be issued upon exercise of outstanding options | Weighted average exercise price of outstanding options | Number of securities remaining available for future issuance | |||||||

Equity compensation plans approved by security holders | 170,761 | $ | 14.48 | 1,140,236(1) | ||||||

Equity compensation plans not approved by security holders | - | - | - | |||||||

Total | 170,761 | $ | 14.48 | 1,140,236(1) | ||||||

(1) | This number includes 434,186 securities available to be issued under the 2011 Stock Option Plan. Although this plan will remain in effect until March 23, 2021, the Company has no intentions to issue new awards under the plan. Future awards are intended to be issued under the 2015 Plan for which the number of |

CORPORATE GOVERNANCE AND THE BOARD OF DIRECTORS

Our

The Company’s business is managed by its employees under the direction and oversight of the board of directors. Board members are kept informed of Commerce Union’sthe Company’s business through discussions with management, materials provided to them by management and their participation in board and board committee meetings.

9

Board Composition and Director Independence

As of AprilJanuary 1, 2015,2018, the board is comprised of eleven14 directors. The board has determined that a majority of its members are independent as defined by the listing standards of the NASDAQNasdaq Stock Market. Specifically, our board of directors has determined that the following directors are independent: Homayoun Aminmadani, Charles Trimble (Trim) Beasley,Darrell Freeman, Jim Kelley (except by independence standards specific to the audit committee), Don Sloan, Jim Hodges, John Lewis (Buddy) Bourne, Trim Beasley, Sharon H. Edwards Darrell S. Freeman, Sr.(lead independent director), James Gilbert Hodges, James R. Kelley,Brown Daniel, and Don Richard Sloan.Rusty Vest.

The board of directors has four standing committees: the executive committee,Executive/Loan Committee, the audit committee,Audit Committee, the compensation committee,Human Resources/Compensation Committee, and the nominating and governanceNominating/Board Governance committee. The board limits membership on the audit committee, the compensation committee and the nominating and corporate governance committee to independent directors as defined by the NASDAQNasdaq listing standards and the rules and regulations of the SEC.Securities and Exchange Commission (“SEC”). The standing committees advise the board of directors on policy origination and plan administrative strategy and assure policy compliance through management reporting from areas under their supervision.

Board Leadership Structure

Currently, the chairman of the board, William Ronald DeBerry, also serves as our chief executive officer, and

DeVan D. Ard, Jr. serves as the company’s president.our Chairman, President, and Chief Executive Officer. Sharon H. Edwards has been appointed by the board to serveserves as the lead independent director. The lead independent director provides leadership to and reports to the board of directors focused on enhancing effective corporate governance, provides a source of board leadership complementary to, collaborative with and independent of the leadership of the chairman and chief executive officer, and promotes best practices and high standards of corporate governance.

We believe this leadership structure is most appropriate for us because we believe having the chief executive officer serve as chairman fosters an alignment of various company leadership duties. Additionally, the company believes that having the person most familiar with all aspects of the day to dayday-to-day operations lead the board of directors enhances accountability and effectiveness. Commerce UnionReliant Bancorp does not have a formal policy with respect to the separation or combination of the offices of chairman of the board and chief executive officer. Rather, the board has the discretion to combine or separate these roles as it deems appropriate from time to time, which provides the board with necessary flexibility to adjust to changed circumstances.

Risk Oversight

Oversight of risk management is a central focus of the board and its committees. The full board regularly receives reports both from committees and from management with respect to the various risks facing the company, and oversees planning and responding to them as appropriate. The audit committee currently has primary responsibility for oversight of financial risk and for oversight of the company’scompany’s risk management processes, including those relating to litigation and regulatory compliance. Under its charter, the audit committee is required to discuss the company’s risk assessment and risk management policies and to inquire about any significant risks and exposures and the steps taken to monitor and minimize such risks. The compensation committee is chiefly responsible for compensation-related risks. Under its charter, the compensation committee must discuss and review the key business and other risks the company faces and the relationship of those risks to certain compensation arrangements. Each of these committees receives regular reports from management concerning areas of risk for which the committee has oversight responsibility.

Code of ConductEthics

The Company has adopted a Code of Conduct,Ethics, which contains provisions consistent with the SEC’s description of a code of ethics, which applies to its directors, officers and employees, including its principal executive officers, principal financial officer, principal accounting officer, controller and persons performing similar functions. The purpose of the Code of ConductEthics is, among other things, to provide written standards that are reasonably designed to deter wrongdoing and to: (1) promote honest and ethical conduct; (2) provide full, fair, accurate, timely and understandable disclosure in reports and documents that Commerce UnionReliant Bancorp files with the SEC and other public communications by Commerce Union;Reliant Bancorp; (3) assure compliance with applicable governmental laws, rules and regulations; (4) require prompt reporting of any violations of the Code of Conduct;Ethics; and (5) establish accountability for adherence to the Code of Conduct. Each director is required to read and certify annually that he or she has read, understands and will comply with the Code of Conduct.Ethics. The Company’s Code of ConductEthics is available on Commerce Union’sReliant Bank’s website atwww.commerceunionbank.com www.reliantbank.com in the Investor Relations area.

10

Meetings of the Boards of Directors

In 2014, all

All of the directors of Commerce Union BancsharesReliant Bancorp also served as directors of Commerce UnionReliant Bank. The Commerce UnionReliant Bank board held nine10 meetings during 2014,2017, and the Commerce Union BancsharesReliant Bancorp board held four8 meetings in 2014.2017. Alldirectors attended at least 85%75% of the aggregate total number of bank and holding company board meetings, and meetings of the bank and holding company board committees on which they served (to the extent held during the period for which the director had been a member of the board(s) or a member of such board committees). Messrs. Daniel, Holloway, and Vest were appointed to the board of directors effective January 1, 2018, and accordingly, attended no board or committee meetings during 2017. The company does not have a policy for director attendance at annual meetings. EachAll but one of our directors was present at the 20142017 annual shareholders’ meeting.

Audit Committee

The audit committee selects and engages Commerce Union’sReliant Bancorp’s independent registered public accounting firm each year. In accordance with its charter, the audit committee, among other things, reviews Commerce Union’sReliant Bancorp’s financial statements, the results of internal auditing, financial reporting procedures, and reports of regulatory authorities, and it regularly reports to the board of directors with respect to all significant matters presented at meetings of the audit committee.

The charter of the audit committee is available on our website atwww.commerceunionbank.com in the Investor Relations area. Effective April 1, 2015, the audit committee is comprised of foursix non-employee directors: Sharon H. Edwards, who serves as chair of the committee, Homayoun (Homey) Aminmadani, Charles Trimble (Trim) Beasley, John Lewis (Buddy) Bourne, Robert E. (Brown) Daniel, and Darrell S. Freeman, Sr., and Homayoun (Homey) Aminmadani, each of whom is “independent” as defined by the NASDAQNasdaq listing standards and the rules and regulations of the SEC. The board of directors has determined that Ms. Edwards, the committee chair, meets the SEC’s criteria for an “audit committee financial expert.” During 20142017, the audit committee met threesix times.

Audit Committee Report

Committee Charter

The audit committee and the board have approved and adopted a charter for the audit committee. In accordance with the charter, the audit committee assists the board in fulfilling its responsibility for overseeing the accounting, auditing and financial reporting processes of the Company. The responsibilities of the audit committee are described in greater detail in its charter. The charter of the audit committee is available on Reliant Bank’s website at www.reliantbank.com in the Investor Relations area.

Auditor Independence

The audit committee received from Maggart & Associates P.C. (“Maggart & Associates”) written disclosures and a letter regarding its independence as required by Public Company Accounting Oversight Board Rule 3526, “Communication with Audit Committees Concerning Independence,” describing all relationships between the independent registered public accounting firm and the Company that might bear on the registered public accounting firm’s independence, and discussed this information with Maggart & Associates. The audit committee also reviewed with Maggart & Associates and financial management of the Company the audit plans, audit scope and audit procedures. The discussions with Maggart & Associates also included the matters required by the Public Accounting Oversight Board Auditing Standard No. 16. The audit committee has also considered, and concluded, that the provision of services by Maggart & Associates described under the caption “Audit and Non-Audit Fees” are compatible with maintaining the independence of Maggart & Associates.

Review of Audited Financial Statements

The audit committee has reviewed the audited financial statements of the Company as of and for the fiscal year ended December 31, 2017, and has discussed the audited financial statements with management and with Maggart & Associates. Based on all of the foregoing reviews and discussions with management and Maggart & Associates, the audit committee recommended to the board of directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2017, to be filed with the SEC.

The foregoing report is submitted by the following members of the audit committee:

Sharon Edwards

Homayoun (Homey) Aminmadani

Charles (Trim) Beasley

John Lewis (Buddy) Bourne

Robert E. (Brown) Daniel

Darrell S. Freeman

Nominating and Corporate Governance Committee

The nominating and corporate governance committee is responsible for: assisting, advising and making recommendations to the board of directors on corporate governance matters, including the identification, selection, and recommendation of qualified individuals to become board members; selecting and recommending that the board approve the director nominees for the annual meeting of shareholders; developing and recommending to the board a set of corporate governance guidelines; developing and recommending a board committee structure and recommending the membership and chairs of committees; overseeing the evaluations of the board; and overseeing the succession planning for the chief executive officer. The charter for the nominating and corporate governance committee can be viewed on our website atwww.commerceunionbank.com in the Investor Relations area.

The nominating and corporate governance committee identifies nominees for the board of directors by first evaluating the current board members willing to continue serving as directors. Current board members with skills and experience that are relevant to our business and who are willing to continue their service are first considered for re-nomination, balancing the value of continuity of service by existing members of the board with that of obtaining new skills, backgrounds and perspective, in light of our developing needs. If a vacancy exists, the committee solicits suggestions for director candidates from a number of sources, which can include other board members, management, and individuals personally known to members of the board.

Pursuant to our guidelines for selecting potential new board members, in selecting and evaluating persons to recommend to the board as nominees for director, the nominating and corporate governance committee strives to select persons who have high integrity and relevant experience and who bring a diverse set of appropriate skills and backgrounds to the board. In this regard, the nominating and corporate governance committee also gives consideration to matching the geographic base of candidates with the geographic coverage of the company, and to diversity on the board that reflects the community that we serve. The nominating and corporate governance committee will also take into account whether a candidate satisfies the criteria for “independence”“independence” under NASDAQ’sNasdaq’s listing standards. These factors are subject to change from time to time.

The nominating and corporate governance committee also evaluates candidates for nomination to the board of directors who are recommended by shareholders. Shareholders who wish to recommend individuals for consideration by the nominating and corporate governance committee to become nominees for election to the board may do so by submitting a written recommendation to Commerce Union’sReliant Bancorp’s Secretary at its executive offices. Submissions must include certain information relating to such person that would indicate such person’s qualification to serve on the board of directors, including that information set forth in Section 3.9 of our bylaws and such other information relating to such person that is required to be

11

disclosed in connection with solicitations of proxies for election of directors, or is otherwise required, in each case pursuant to Regulation 14A under the Securities Exchange Act of 1934. The nominating and corporate governance committee will consider recommendations received by a date not later than 120 days before the anniversary date of the mailing of our proxy materials in connection with the prior year’s annual meeting of stockholders for nomination at the next annual meeting. The nominating and corporate governance committee will consider nominations received beyond that date at the annual meeting subsequent to the next annual meeting.

There is no difference in the manner in which the nominating and corporate governance committee evaluates candidates for membership on the board based on whether such candidate is recommended by a shareholder, the nominating and corporate governance committee, a director or by any other source. No submission for board nominees by a shareholder was received by the company with respect to the annual meeting.

Effective April 1, 2015,

The charter of the nominating and corporategovernance committee is available on Reliant Bank’s website at www.reliantbank.com in the Investor Relations area. The nominating and governance committee is comprised of James R. Kelley, the chairman, Homayoun (Homey) Aminmadani, John Lewis (Buddy) Bourne, Don Richard Sloan, and John Lewis (Buddy) Bourne.Ruskin (Rusty) A. Vest. Each member of the committee is independent, as determined under the definition of independence set forth in NASDAQ’sNasdaq’s rules and listing standards. During 2014,2017, the nominating and corporate governance committee’s responsibilities were overseen by the entire board, whichcommittee met nine times.once.

Compensation Committee

The compensation committee assists, advises, and makes recommendations to the board of directors on executive and director compensation matters, including evaluating and recommending to the board compensation and benefit plans for executives and directors of Commerce Union,Reliant Bancorp, as well as evaluating the performance of Commerce Union’sReliant Bancorp’s executives. The compensation committee also has been delegated responsibility for making certain compensation decisions relating to Commerce Union’s executives and under Commerce Union’s equity compensation plans. The compensation committee solicits the recommendation of our chairman, and chief executive officer, and our president, and the independent consultant of the compensation committee with respect to compensation determinations concerning the other executive officers of Commerce Union,Reliant Bancorp, but does not delegate its authority with respect to compensation matters to any other person.

The compensation committee engaged an independent consultant, Matthews, Young and Associates, Inc. (“Matthews Young”) to review and provide recommendations regarding components of our executive compensation program throughout the year ended December 31, 2017. The compensation committee also may request others, including compensation consultants and legal counsel, to attend meetings or to provide relevant information to assist the committee in its work. In this connection,regard, the compensation committee has the authority to retain compensation and benefits consultants and legal counsel used to assist the committee in fulfilling its responsibilities.

In retaining Matthews Young as the committee’s advisor, the compensation committee reviewed the factors described in the Dodd-Frank Act in evaluating the consultant’s independence status. The compensation committee’s review and findings include:

Review of services provided to the Company, determining that all consulting services were provided directly to the committee or with the committee’s advance review and approval.

Review and determination that the consultant’s total fees for services to the Company were not a material percentage of Matthews Young’s total consulting revenues.

Discussion of the policies and procedures employed by Matthews Young to prevent conflicts of interest.

Determination that the consultant has no business or personal relationship with any member of the committee or with any member of executive management.

Determination that the consultant owns no common stock in the Company.

The charter forof the compensation committee can be viewedis available on ourReliant Bank’s website atwww.commerceunionbank.com www.reliantbank.com in the Investor Relations area.

As of April 1, 2015, the The compensation committee is comprised of James (Jim) Gilbert Hodges, chairman, James (Jim) R. Kelley, Charles Trimble (Trim) Beasley, and Darrell S. Freeman, Sr. Each member of the committee is independent, as determined under the definition of independence set forth NASDAQ’sNasdaq’s rules and listing standards. During 2014,2017, the compensation committee met four4 times.

COMPENSATION OF DIRECTORS AND EXECUTIVE OFFICERS

Committee Effectiveness Review

The charters of the audit, nominating and governance, and compensation committees require an annual review of committee effectiveness by the members of each committee. During 2017, consultants from Matthews Young administered a confidential survey for each committee covering a range of factors including structure; number, duration, and effectiveness of meetings; and engagement and effectiveness of members. All members of each committee participated in the process. Consultants prepared reports of survey results that were reviewed committee chairs who, in turn, reviewed with their respective committee members.

Compensation Practices Review

On an annual basis the compensation committee reviews its compensation policies, plans and practices as required by the SEC. The focus of this review is to identify any risks arising from compensation policies, plans, or practices that are “reasonably likely to have a material adverse effect” on Reliant Bancorp or its subsidiaries. In turn, the committee takes action as necessary to eliminate or mitigate such risks. This review covers executive officers as well as all employees.

Between December 2017 and January 2018, the compensation committee conducted the risk assessment of compensation and reviewed a comprehensive report on all variable compensation plans that offer cash or stock as bonus/incentive compensation. The committee found that Reliant Bancorp’s compensation policies, plans, and practices do not encourage unnecessary or unreasonable risk-taking and do not give rise to risks that are reasonably likely to have a material adverse effect on Reliant Bancorp or its subsidiaries. Compensation plans are designed to balance the various elements of compensation (salaries, short-term bonus/incentives, and long-term incentives) and, in turn, create a balanced focus on operating results, long-term performance, and the creation of shareholder value. Key plans related to executive officer cash incentives and all stock-based grants are administered by the compensation committee and the board of directors.

Compensation Philosophy

Reliant Bancorp’s overall executive compensation philosophy is to align its compensation program with optimizing shareholder value. To that end, the program is designed to recognize superior operating performance and to attract, retain and motivate the executive talent essential to the Company’s financial success. Consistent with this philosophy, the compensation committee is guided by the following objectives when administering the Company’s overall compensation program:

● | Attract and retain highly qualified executives who portray the Company’s culture and values; |

● | Motivate executives to provide excellent leadership and achieve the Company’s goals; |

● | Provide substantial performance-related incentive compensation that is aligned with the Company’s strategies and directly tied to meeting specific Company and market objectives; |

● | Strongly link the interests of the executives to the value derived by the Company’s shareholders from owning the Company’s common stock; and |

● | Be fair, ethical, transparent, and accountable in setting and disclosing executive compensation. |

In furtherance of these objectives, the following considerations underlie the compensation committee’s determination with respect to the following principal elements of compensation for the named executive officers:

Base Salary | Individual salary determinations are based upon the officer’s job assignment, qualifications, behaviors, cultural adherence and performance. |

Annual Cash Incentives | Executives have a portion of their total cash compensation at risk and contingent upon meeting key Company and market objectives. |

Cash Bonuses | Executives are eligible for additional cash compensation in the form of bonuses (distinct from annual incentives) which recognize significant achievements and contributions to the Company’s success that are not captured under our annual incentive plan. |

Long-Term Equity-BasedAwards | Executives who are critical to the Company’s long-term success participate in long-term incentive opportunities that link a portion of their total compensation to increasing shareholder value. |

Retirement Plans and Other Benefits | Executives participate in the Company’s benefit programs, such as health insurance, 401(k) plan, vacation, and life insurance, at a level consistent with policy, prevailing law and current regulation. |

Total compensation is intended to correlate to the Company’s ability to grow earning assets, which in turn enhances the Company’s growth in shareholder value. The compensation committee did not use competitive salary surveys to determine or measure the total compensation of the named executive officers. However, the Company’s compensation consultant has provided the committee with a report on market salary levels for the review of executive and officer salaries. A portion of each named executive officer’s total compensation consists of cash payments, including base salary and/or annual cash incentive awards.

Compensation of Directors and Executive Officers

Summary Compensation Table and NarrativeNarrative for Fiscal Year 20142017

The following table shows